The NoBroker Story

NoBroker has 85% market share among rental proptechs. But that's only 10% of the overall rental market. Today NoBroker is at ₹1,000-crore annual run rate from 6 cities. Amit Agarwal tells the story.

How perfect should the first version of your product be?

If you are reading this photoblog, you have probably used NoBroker or at least heard of someone who has.

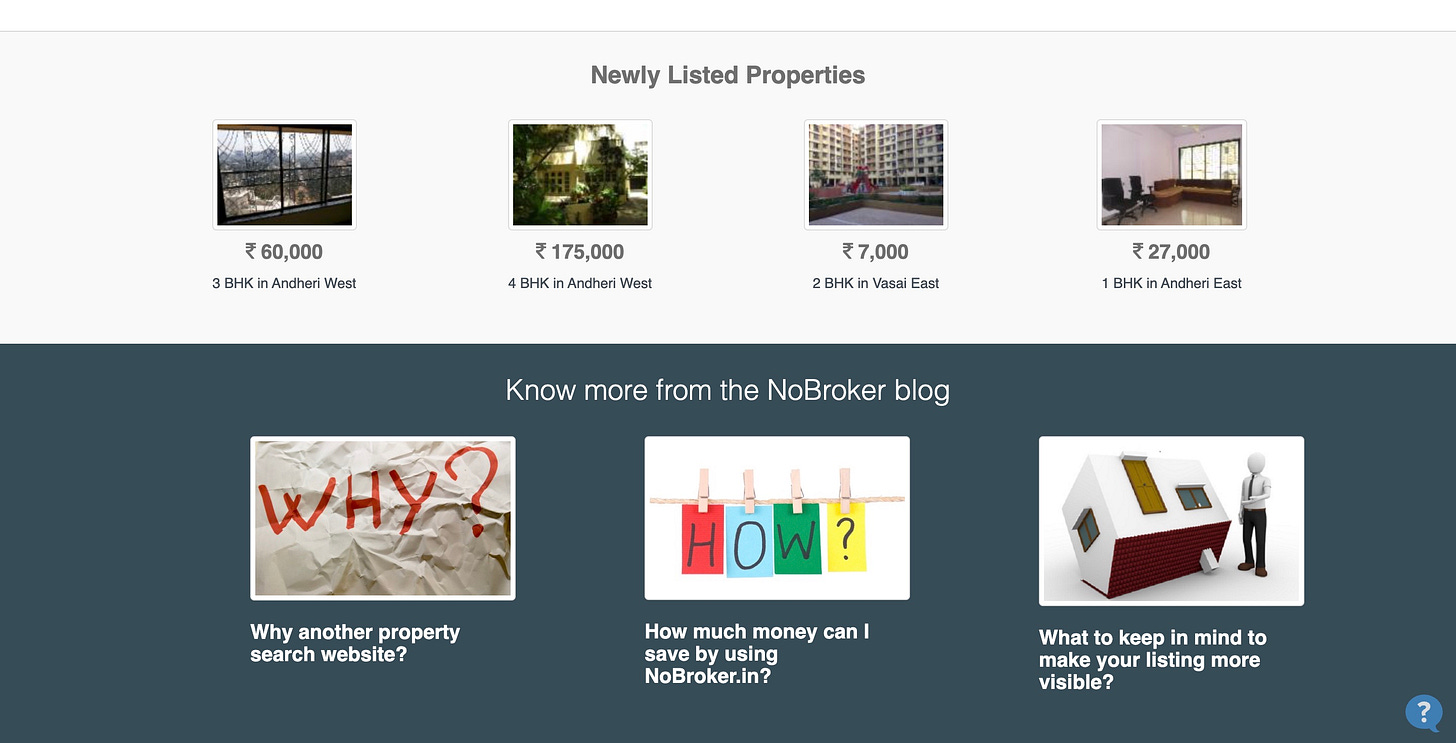

NoBroker.in went live on 1 March 2014. This is the first listing on the website, which they also listed on their Facebook page on 5 March 2014:

This is their story as narrated by Amit Agarwal.

Table of Contents:

Early Life

It's hard to imagine this today, but when Amit Agarwal entered IIT Kanpur in 1996, he had never used a computer.

"I did not know how to even switch on the computer when I went to IIT. So that knowledge of computers was zero," Amit recalls.

After graduating from IIT Kanpur, Amit worked as a programmer at Cognizant Technology Solutions for two years. He then decided to pursue his Masters and secured admission to the prestigious Indian Institute of Management, Ahmedabad (IIM-A).

At IIM-A, Amit met Saurabh Garg, who would later become his co-founder at NoBroker. "My co-founder Saurabh was my batch mate and was my dorm mate. We were on the same floor in IIM Ahmedabad," Amit shares. The third co-founder, Akhil Gupta, was Amit's junior from IIT.

After completing his MBA, Amit followed the typical path for IIM graduates at that time (and even today) and entered the consulting world. He would spend nearly a decade in consulting, working across multiple cities in India, including Mumbai, Bangalore, and Kolkata.

Meanwhile, Saurabh would spend a couple of years in Unilever before founding a health spa chain. Akhil did his Masters as well from IIT-Bombay and worked in Oracle.

The Broker Problem: Personal Pain Points

During his consulting career, Amit faced a problem that millions of Indians encounter – dealing with real estate brokers while trying to rent homes in different cities. These experiences would later become the genesis of NoBroker.

Amit shares a particularly painful story from his time in Kolkata:

"I basically gave some money to a broker as an advance because I wanted him to arrange for some rental furniture. And he just vanished with the money. So there was no trace of the money."

In Bangalore, he experienced different but equally frustrating tactics:

"While he's talking to you, he's measuring you, which city you are from, how long have you been in the city, which company you work for. He notices the car that you have come in. So he basically weighs you — and will know that this guy is not from this town."

Amit explains that brokers will often show the worst properties first, trying to push their "non-moving inventory" onto newcomers to the city who might not know better.

"He's trying to push the non-moving houses. So only when you revolt, then he will say, okay, I'll show you something good."

Akhil and Saurabh also had similar experiences while working in jobs in their corporate careers across India. These experiences led the trio to a crucial insight:

"It was obvious that the brokers’ interests and our interests are not aligned. Their interest is to basically get the brokerage."

The Inception Of NoBroker

Around 2012-2014, Amit, Saurabh, and Akhil began discussing these shared frustrations with real estate brokers. All three had lived in rental homes across different cities and had dealt with brokers repeatedly.

When Housing.com launched, they were initially hopeful that it would solve their problems.

"We were very hopeful. We felt that Housing.com is going to solve this problem," Amit recalls. But they soon realized that even Housing.com was working with brokers rather than creating a direct connection between property owners and tenants.

"We got very demotivated that, hey, come on. Even Housing.com, 99 Acres, Magicbrick — all of them are working with the brokers." Amit says.

That's when the idea for NoBroker began to take shape. The emergence of widespread internet access in India made this possible in a way it hadn't been before.:

"We thought that why shouldn't there be a platform which connects owners and tenants directly with each other?"

"We felt that now the internet has come. Why shouldn't internet be able to solve this problem?"

In NoBroker’s case a lot of it is in the name — clearly communicating their mission ended up converting their name into a franchise.

Amit notes that the company's very name created an important commitment:

“Because we named our company NoBroker, there was no way that we could make money from brokers in the long run as well. That option itself was gone. So, we basically then stuck to our philosophy that it will be non-brokerage, forever.”

There was one significant concern, however:

"The tough part was that nobody had done it in a developed country. Uber is there. And Amazon is there. But there is no consumer internet company solving what we were solving."

This lack of precedent in more technologically advanced markets would later become a challenge when pitching to investors. But at this stage, the founders were driven by a shared conviction rather than market validation.

"I think we were too ignorant to be scared," Amit admits. "So we thought, yeah, this is a good idea. Why shouldn't we give it a try?"

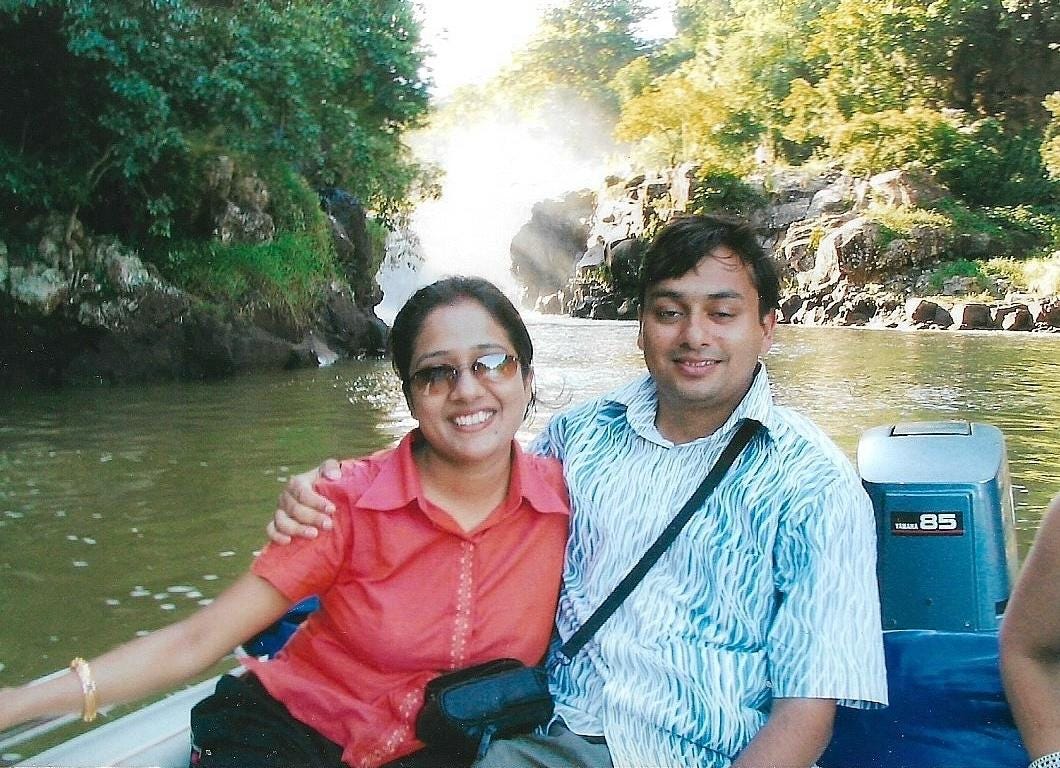

Your Partner Is Always Your Cofounder

While the founders were taking immense personal risks, all three of them contributed equally to funding the company during its bootstrapping phase, with Amit taking on the role of CEO and quitting his job first.

"I had a kid by then and my wife and I were expecting the second one when I left my job," Amit reveals.

"She's my batch mate from IIT Kanpur. And imagine she was saying OK to me to start a company while she was expecting."

"She wanted to take a sabbatical of two years because she felt that she was not able to spend time with our first kid. She wanted to spend time with the second kid, but she couldn't because we were now starting a company.”

“So the second kid was born while I was unemployed."

Your partner is always your cofounder. This simple point cannot be understated.

Launching On A Shoestring Budget

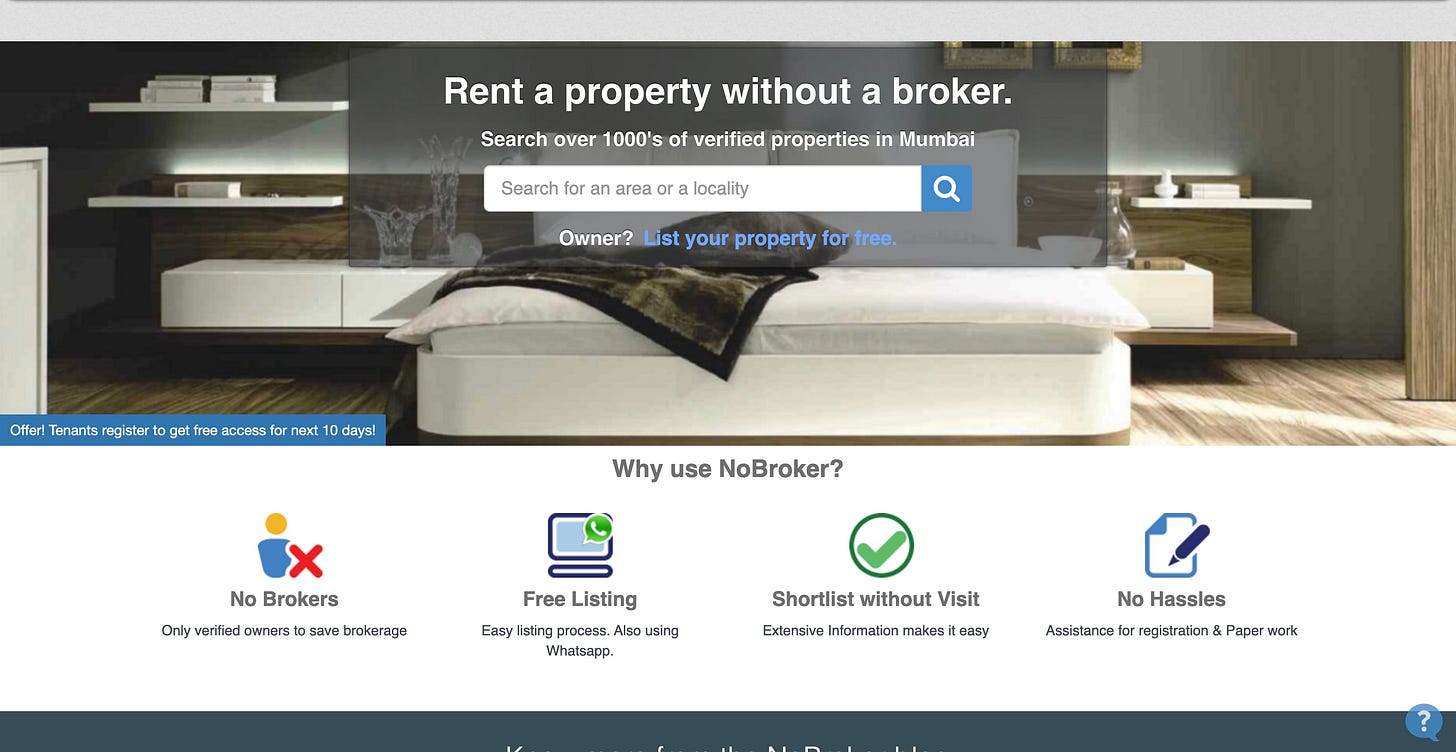

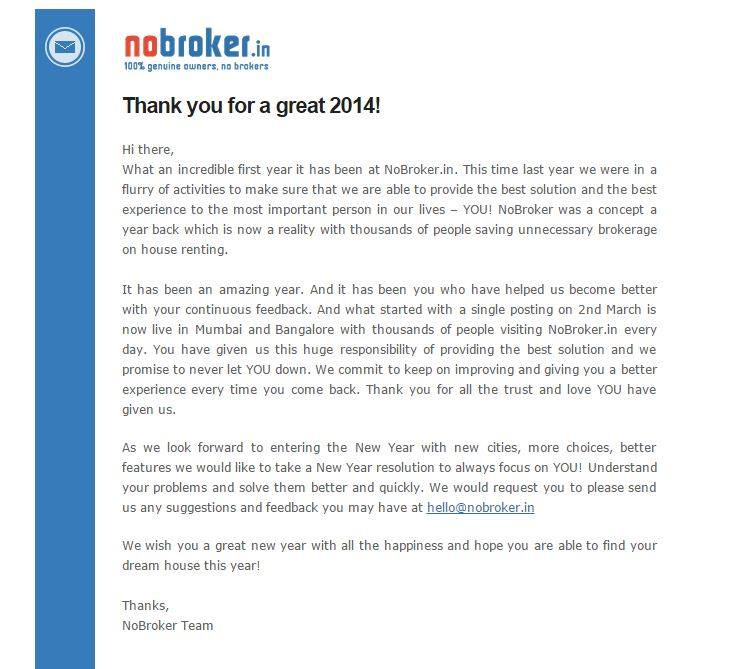

NoBroker officially launched on March 1, 2014.

Amit notes:

“The product went live on 1st March, and so it is now going to be 11 years.”

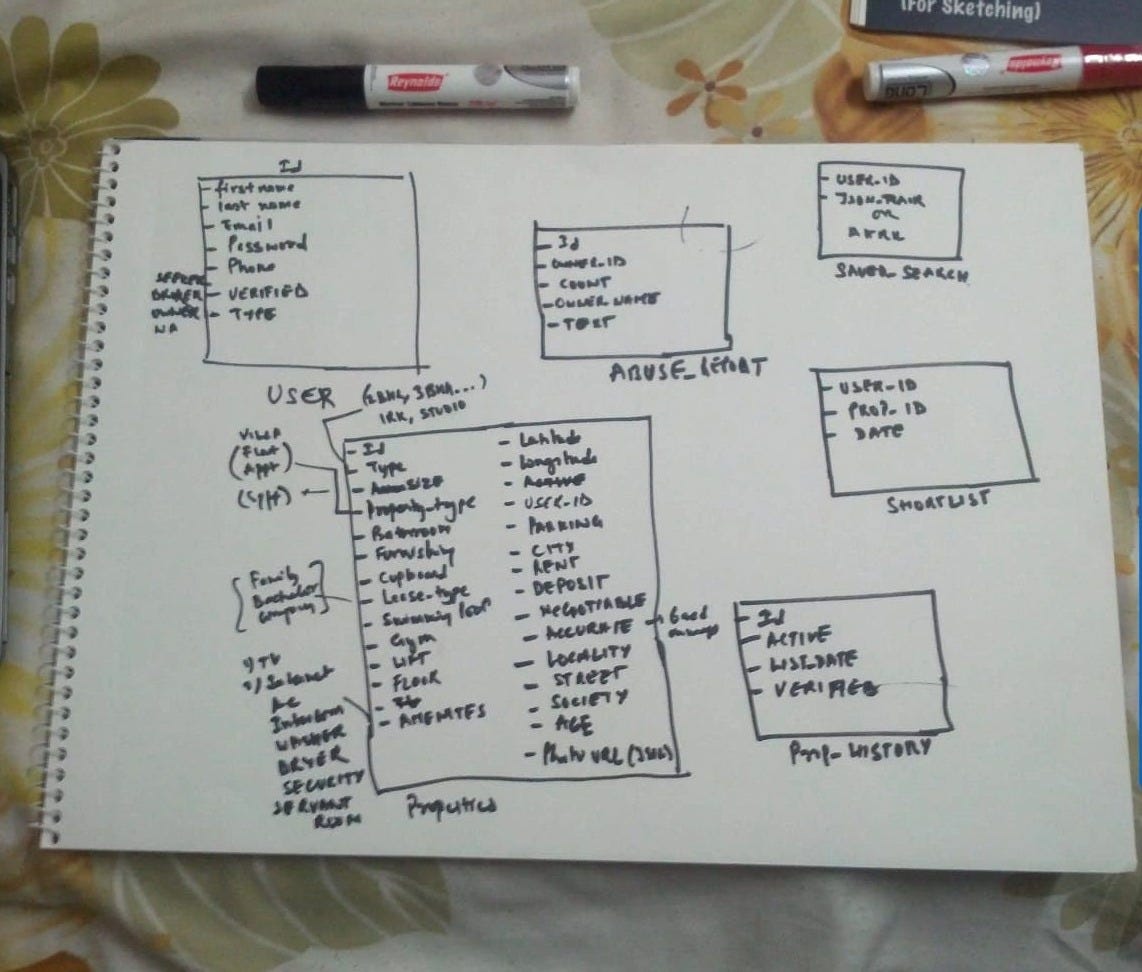

Akhil Gupta coded and managed the NoBroker website almost single-handedly during their bootstrapping days for 11 months in 2014-15. Meanwhile, Amit and Saurabh focused on building supply and demand.

The first year was entirely bootstrapped from the founders' savings. The company had no office, and the focus was on building a basic product and securing funding.

Amit explains:

“We had no office in 2014 — our first office happened one year later. So this one year basically was the period when we had to arrange for funds from our savings."

Early Traction

During the bootstrapping period, NoBroker's metrics were modest by typical startup standards.

They also made a strategic decision not to charge users immediately, recognizing that the platform needed to reach a critical mass before monetization would make sense:

“In a city, it is much, much more difficult because you launch a site, you let it grow organically in a given area and let supply build up in specific areas.”

“Initially, you need customers who are much more patient and who will give you a chance.”

Revenue was non-existent, and user numbers were small.

"Revenue was zero in 2014. Zero for the first half of 2015," Amit states candidly.

"I think there were about a thousand customers a month back then."

The founders were content with this slow growth given their limited resources:

"We were pretty happy with a thousand customers a month because you can imagine that we're putting our own money from our own savings account. So how much can you put up anyway?"

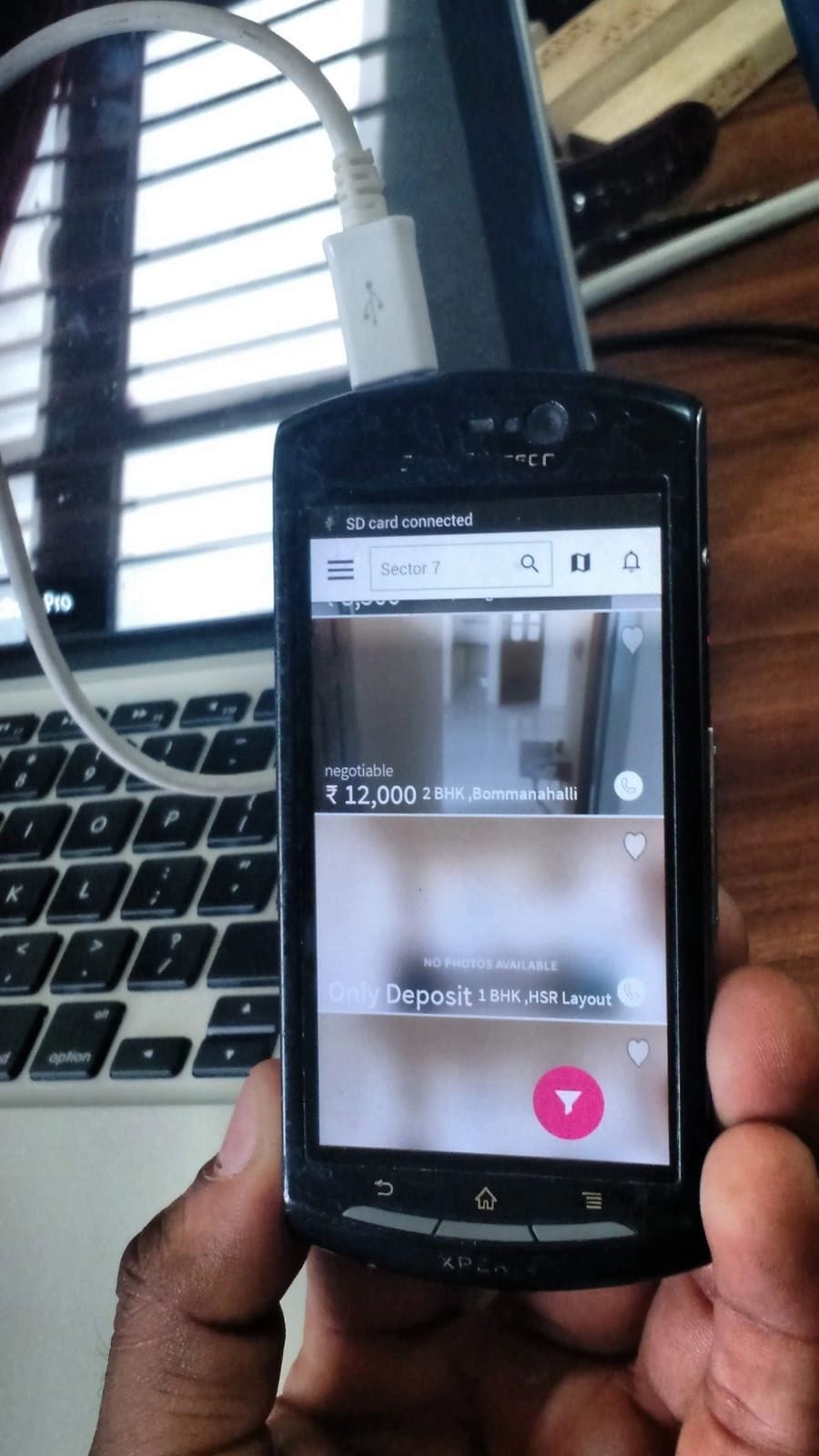

The initial website was basic, with the app following a year later in 2015 after the company secured funding.

Interestingly, the founders were initially skeptical about developing a mobile app:

“We were in two minds. Why should there be an app? Because we felt that, hey, this is anyway going to be used by people once in a year.”

“So why will somebody use an app and block the memory of the mobile phone?”

It was actually investor pressure that led them to develop the app:

“Investors were very convinced that it is essential that we have an app.”

Broker Attacks!

Perhaps one of the most dramatic aspects of NoBroker's journey has been the physical resistance from brokers whose market the company has disrupted.

11 years of building NoBroker has seen the company withstand several such broker attacks across the cities it operates in.

Amit shares a more recent incident which is a couple of weeks old:

“We have our field relationship managers — they help the customers… they show the flats to the customers. When the owner is not living in the house, they hold the key and they show the flat. The owner also trusts us, of course.”

“In this one case in Pune couple of weeks back, what the brokers did was that they basically bribed the security guards of an apartment. And the moment our guy came into the society, the security guards called up the brokers.”

“The brokers came and they beat up our relationship manager."

This wasn't an isolated incident:

"This happened 7-8 times in Pune. We had to lodge a police complaint. Thankfully, police helped us a lot and it is under control. But sporadically this happens even today."

Amit finds this resistance unfortunate and counterproductive:

"It's like basically saying what if a Kirana shop guy starts beating up Zepto or Blinkit guys, right?”

“Think about what is best for the customer and you upgrade your game."

Convincing Early Investors

Initially, when pitching to investors, the NoBroker founders faced a common yet challenging question:

"Why isn't US or China doing it?" Amit recalls this as their "biggest question" from potential investors.

"Because in their minds, if idea was so good, why is it not already there in the West? All of them agreed that brokers are a problem in India. But their question was — is there something that we are missing?"

Amit's response was twofold:

"One, we don't know because we are not Americans, we are not Chinese. Second, this is a very India specific problem."

He also offered a hypothesis about why similar models hadn't emerged in more developed markets:

“In the US, the brokers are registered, they have a certification, they have an examination, they have a license.”

“They can't take money and run away like it happened with me in Kolkata.”

“So, they are bound by law, they don't collect money in cash, they don't do it like a part-time business that you have a grocery shop and you're also a broker.”

In 2015, after a year of bootstrapping, NoBroker secured its first institutional funding. Amit notes:

“$3 million check from Elevation Capital (back then called SAIF Partners) and Fulcrum Ventures at a post-money valuation of $10 million is what we started with.”

Investors also raised concerns about competition:

“What if housing.com launches no brokerage as well?”

To this, Amit offered a philosophical response:

“This question applies to every consumer internet platform in India. What if the competition does it? And competition often does.”

“The only absolute answer is that I'm more passionate about this idea than anybody else. And hence, I'm going to basically grow faster than anybody else. Before they realize what's happening.”

Building a Two-Sided Marketplace

One of NoBroker's biggest challenges was building the supply side of its marketplace, which involved getting property owners to list on its platform.

Property owners, particularly older ones, were often not tech-savvy and less likely to discover NoBroker online.

Amit explains:

“This is a much more difficult business to run because you aren’t acquiring brokers on the other side. Because then like other players do, you can just do digital marketing, get lots of tenants, your site will have an inflection point.”

“But when you are asking a genuine owner to come, it is extremely painful because often these are older folks and they aren’t exactly surfing the internet all the time.”

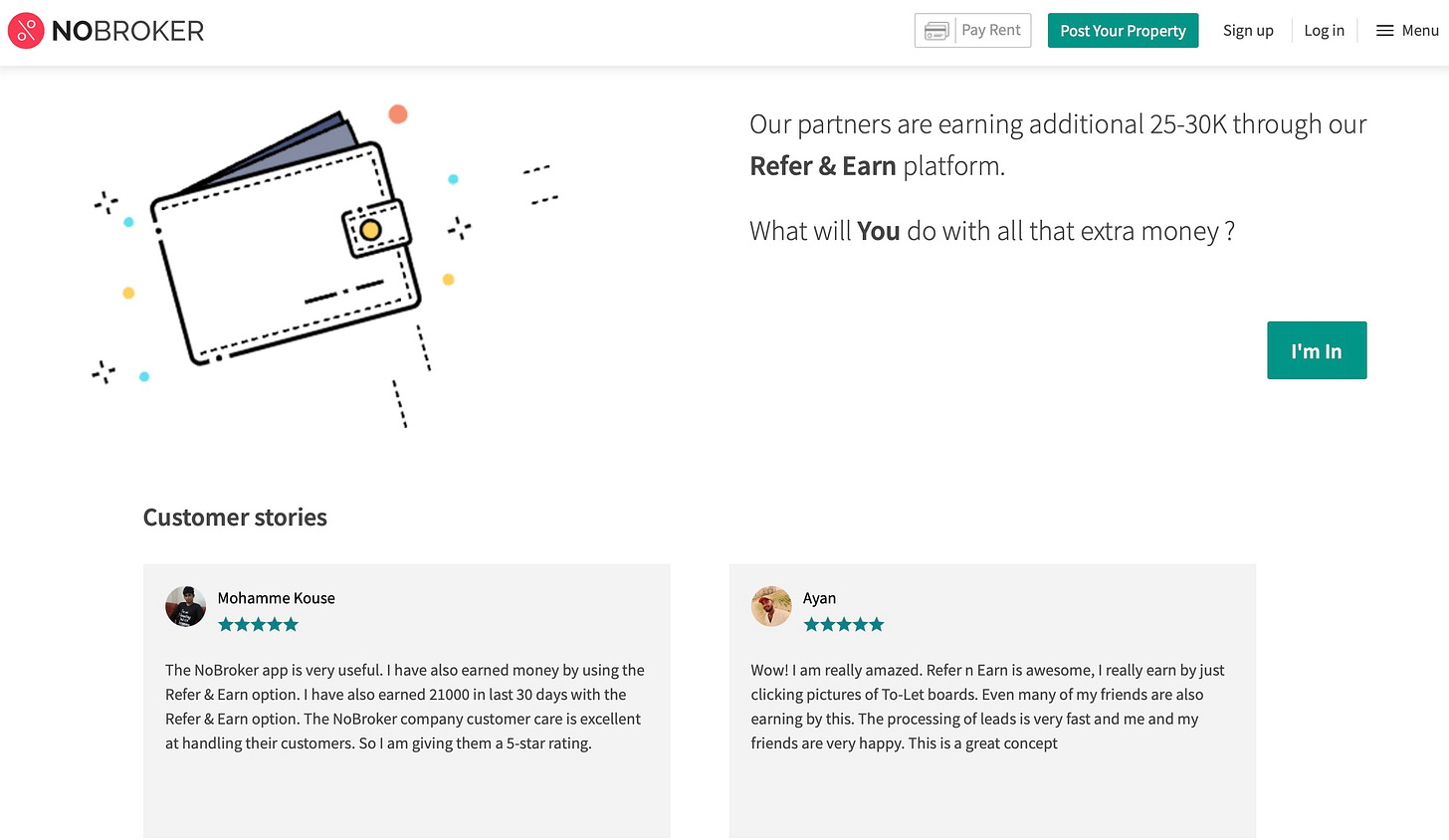

To solve this problem, the company came up with an innovative feature called "Click And Earn."

Amit explains:

“If there's any property, which is to be rented out, the owner will usually put a 'To Let' board in front of the house.”

“We earlier, we used to roam around the city and whenever we used to see such a board, we used to click photos and send it to our call center."

“A team member named Shiv suggested that we productize this — turning this manual process into a product feature accessible to anyone through the app.”

“We said that any passerby can click a photo of such a board with the phone number of the owner, and can then upload it in NoBroker. And we are going to pay you up to ₹120 for every converted lead."

Initially, the founders were skeptical:

“We were skeptical. Our question was that even if you put in our app, who will notice it? Why will they click a photo? We had no idea what was about to happen…”

They were surprised by the response, particularly from younger users:

“Many of the youngsters, many of the people who are college going students, they want to give it a try because for them it's good pocket money.”

This feature, launched in 2015, has become a significant acquisition channel:

"Out of the 3 crore users on NoBroker today. half will be tenants, half will be owners, and almost 10% of the owners would have come through Click And Earn — this was critical in the beginning."

“This is a good example of doing something that is non-scalable and you do it in a jugaad manner because you just want to get your first customers. And then thinking how do we scale this after it shows some results.”

To build the demand side of the business, NoBroker charges a subscription fee from the tenants only after they get 9 free connections (contact details) with owners. The tenants take a subscription fee if they need to connect with more than 9 owners.

Approximately 55% of the NoBroker’s revenue is driven by subscription sales.

Unlike many internet businesses that can achieve rapid growth with enough capital, NoBroker's growth was slower and more methodical:

“Networks, especially the supply side of owners, are very difficult to build. That is why no one else in the world has done it. Because there is no shortcut, money is not a shortcut for building a no-brokerage business.”

Amit emphasizes this point strongly:

“Today, if you give a billion dollars also as funding to any other company, they still will not be able to beat us. It is still going to take them three to five years to catch up with our current levels.”

The reason? The inherently need-based nature of real estate transactions:

“Just as a customer, you would not go and rent your house if you just see a good ad. You will rent your house when you have to rent your house, that is it. It is a very need-based thing.”

This fundamental characteristic meant that NoBroker couldn't experience the rapid growth curves typical of many consumer internet businesses:

“There was no inflection point in this business because it is not a regular use product that can be pushed via influencers or TV ads.”

“It is slow and continuous compounding.”

The only natural seasonality came during the summer months:

“Whenever there's a March, April, May period, then because of summer vacation, change of jobs, change of school, there is a seasonality wherein there is some bit of spike.”

These approaches helped them maintain growth without resorting to expensive television advertising, which Amit points out came “very, very late” in the company's journey.

“The objective was to be very frugal and innovative in spending money and marketing to get customers,” Amit explains.

The Service Ecosystem

As NoBroker grew, the founders realized they had a unique opportunity that other real estate platforms lacked: direct access to property owners and tenants at the moment of transaction.

Amit explains:

“When we look at other real estate platforms across the world, they do only real estate. But the root cause is not that other ancillary services don't have opportunity. The root cause is that they don't have the phone number of the owner. They have brokers.”

This insight led NoBroker to expand into complementary services:

“So, once you realize this small, but game-changing insight that you have both sides. So, I can do Packers and Movers. I know when the deal is getting closed. I can do rental. I can do legal documentation. I can do more periods. I can do the whole service.”

This strategy not only created additional revenue streams but also became a growth driver for the core business:

“I think that is another insight, another hack, which exploded our growth because then we said, we are not going to solve only one problem. We have à la carte.”

Today, these additional services account for approximately 45% of NoBroker's revenue, with the core real estate business contributing the remaining part.

Confounding Compounding

NoBroker's growth has been a testament to the power of patient, consistent execution.

From the thousand monthly users in its early days, the company now adds 5 lakhs customers per month.

In terms of revenue, NoBroker operates in just six major Indian cities at the moment: Mumbai, Bangalore, NCR (treated as one city), Pune, Chennai, and Hyderabad. Yet it generates approximately ₹85 crores in monthly revenue, with an annual run rate of approximately ₹1,000 crores.

Amit reflects on this remarkable journey:

“It took us 10 years to acquire 2.5 crore customers. But after that, within one year we are adding more than 50 lakh customers — we are reaching 3 crore customers now. So the curve is very, very steep now.”

“This is the power of compounding.”

“This is a business in which you cannot get any inflection point. This is an elbow grease business. You put your head down, just focus on solving customer problem every day, slowly, gradually, you put a fight every day and suddenly you will see that, hey, the numbers one year back was this and today now it is double, triple, and so on.”

How does all this translate into revenues?

Since it is a game of capturing market share, NoBroker must keep investing money into building the market.

And the market is quite big as Amit points out:

“If you look out of your window right now, and if you look at 10 homes, which you can see, how many homes has NoBroker done? Perhaps one. In Bombay, I think it is 1 out of 10 or 1 out of 20, right? In Bangalore, I can say two out of 10.”

“We are number one in real estate in online space. But space is not online. Space is online plus offline. This is the true opportunity.”

Amit estimates that NoBroker has 85% of the online real estate market, but only about 10% of the total market (online plus offline). And with major cities like Kolkata, Ahmedabad, Jaipur, and Visakhapatnam still untapped, the growth runway remains substantial.

Over time, this consistent execution has led to widespread brand recognition. Amit shares:

“For so many years in the beginning, whenever I went to an event to speak, I'd ask — ‘how many people have heard about NoBroker?’ And some people will raise their hands.”

“At some point I started noticing that everybody was raising their hands. So my wife said, ‘come on, now, stop asking this question’.”